Directional Trading Combination Strategies

These strategies target anticipated market movements (up or down) through strategic combinations. By blending different options strategies, traders can respond to market changes more flexibly while improving returns and controlling the risk effectively.

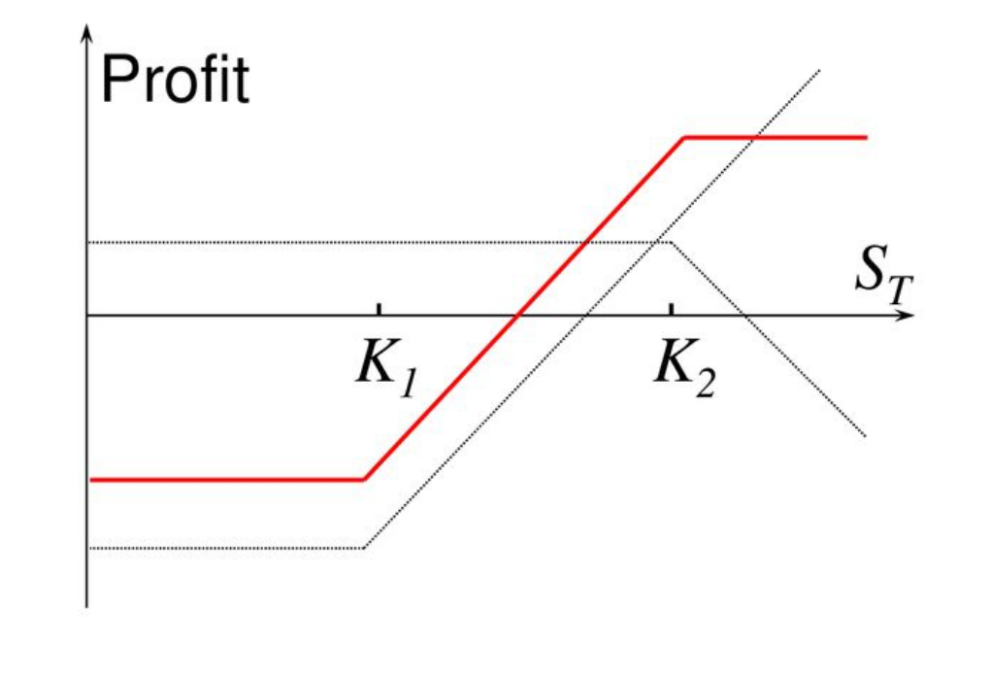

Bull Call Spread Strategy

The bull call spread is a limited-risk, limited-return option combination strategy designed for traders who are bullish but don’t expect dramatic upside.

Strategy Components:

Buy one lower-strike call option

Sell one higher-strike call option Both options share the same expiration date

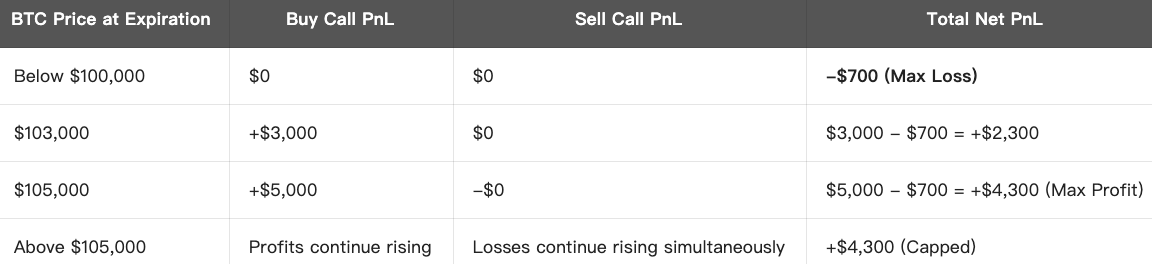

Example (Using BTC):

Assume that current BTC market price is $100,000. You expect BTC to rise in the next few days but with limited upside (perhaps to $105,000 max):

Total Cost (Net Expense):

= Premium paid - Premium received = $1,200 - $500 = $700

PnL at Expiration:

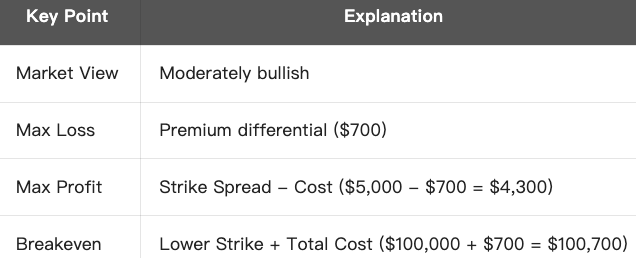

Strategy Summary:

Conclusion:

The Bull Call Spread Strategy is suitable for the moderately bullish market, using lower cost for a higher winning rate of risk-return balance.

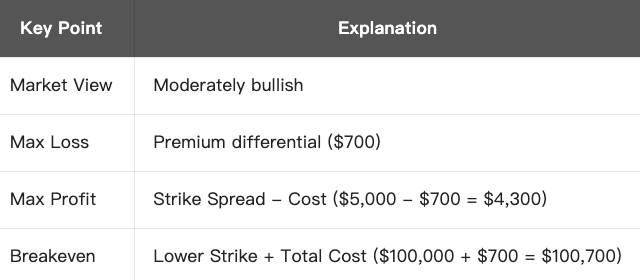

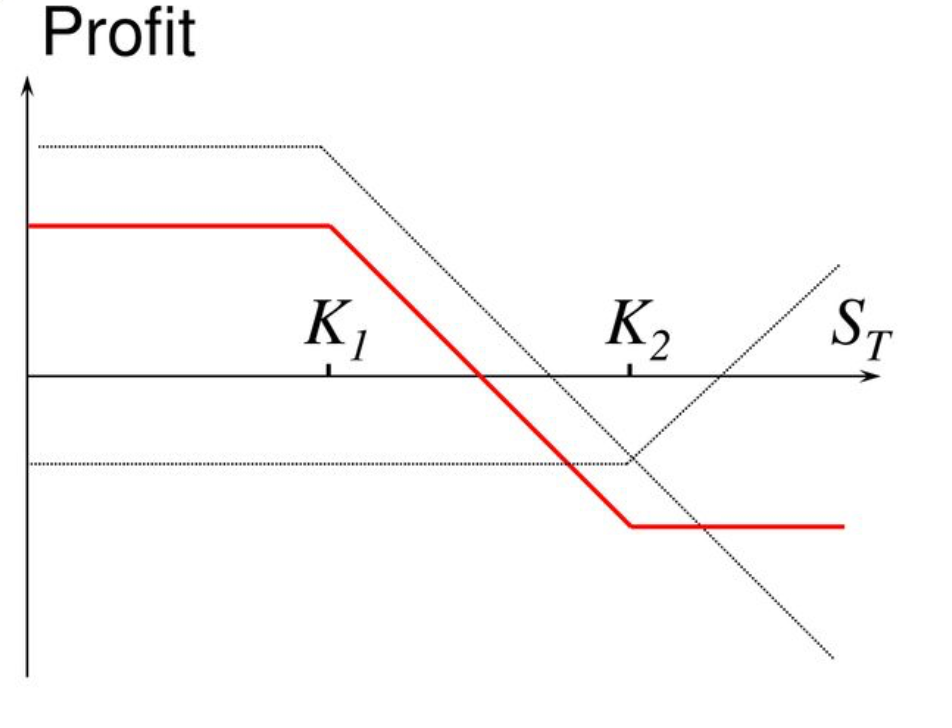

Bear Call Spread Strategy

The bear call spread is a limited-risk, limited-return strategy suitable when you expect the market to decline or trade sideways, unlikely to rally significantly.

Strategy Components:

Sell one lower-strike call option

Buy one higher-strike call option Both options share the same expiration date

Note: Unlike the bull call spread Strategy, this combination generates net premium income.

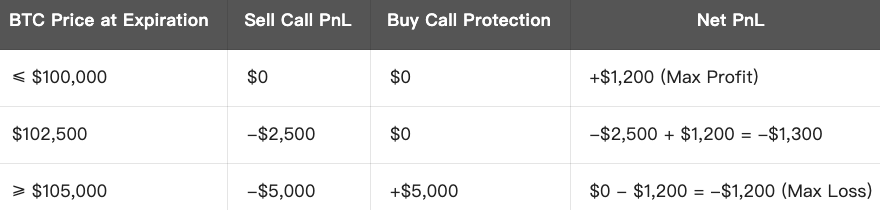

Example (BTC ≈ $100,000):

If you believe BTC won’t rise above $105,000, you can follow the strategy below:

Net Premium Income:

= $2,000 (Sell) ‑ $800 (Buy) = $1,200 (Max Profit)

PnL at Expiration:

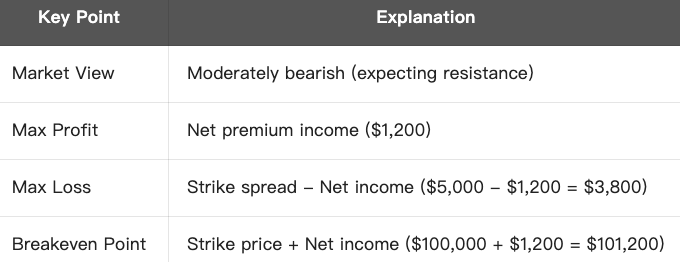

Strategy Summary:

Conclusion:

The Bear Call Spread is a conservative strategy for bearish or range-bound markets, profiting if the price doesn’t rise significantly, suitable for stable or weak market conditions.

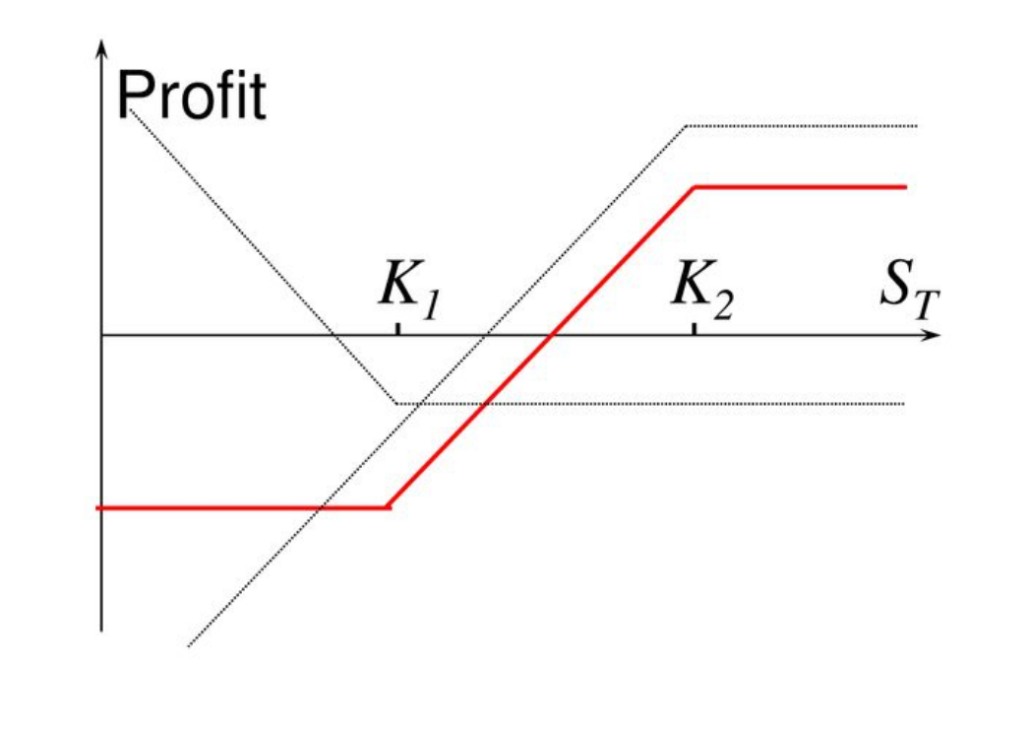

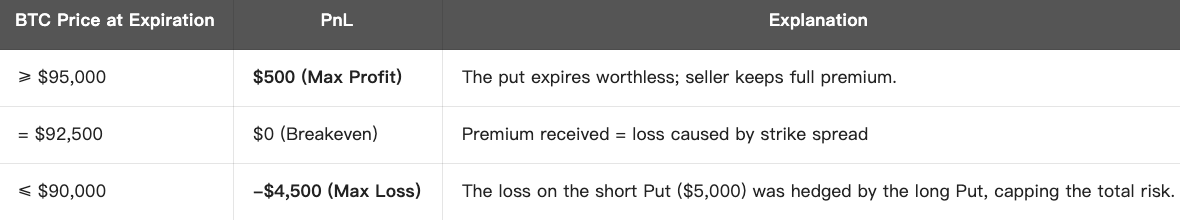

Bull Put Spread Strategy

Bull Put Spread is a directional option combination strategy used when moderately bullish or expecting the market not to fall below a certain level. It involves selling and buying puts at different strikes, limiting both risk and reward.

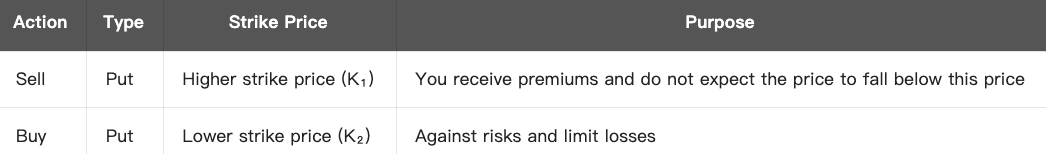

Strategy Components:

Requirements:

Same expiration date; K₁ > K₂.

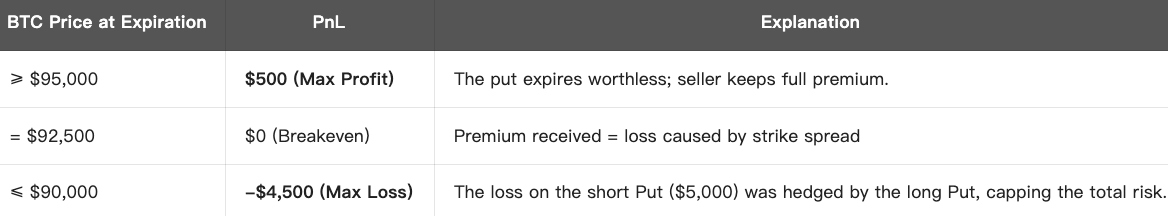

Example (Using BTC):

Current BTC price: $100,000

If you believe BTC won’t drop below $95,000, you can follow the strategy below:

- Net income = $1,000 − $500 = $500 (max profit)

- Max Loss = Strike spread − Net income = $5,000 − $500 = $4,500

PnL at Expiration:

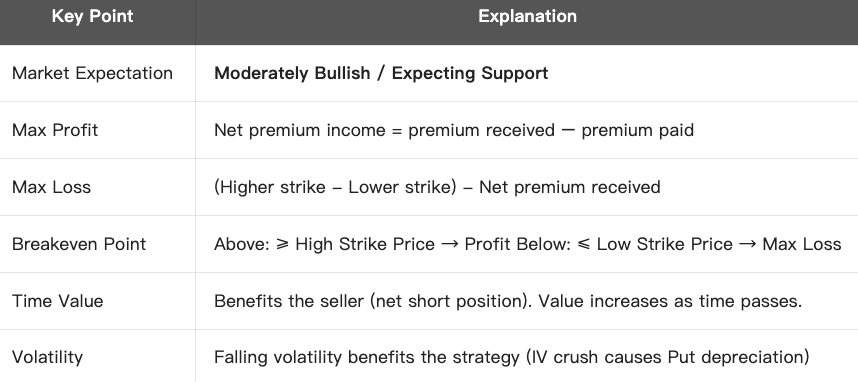

Strategy Summary:

Conclusion:

Bull Put Spread is a limited-risk, limited-reward short Put combination strategy, ideal when you expect the underlying to appreciate or maintain support above a key level,offering better probability of success than outright long positions while keeping risk manageable.

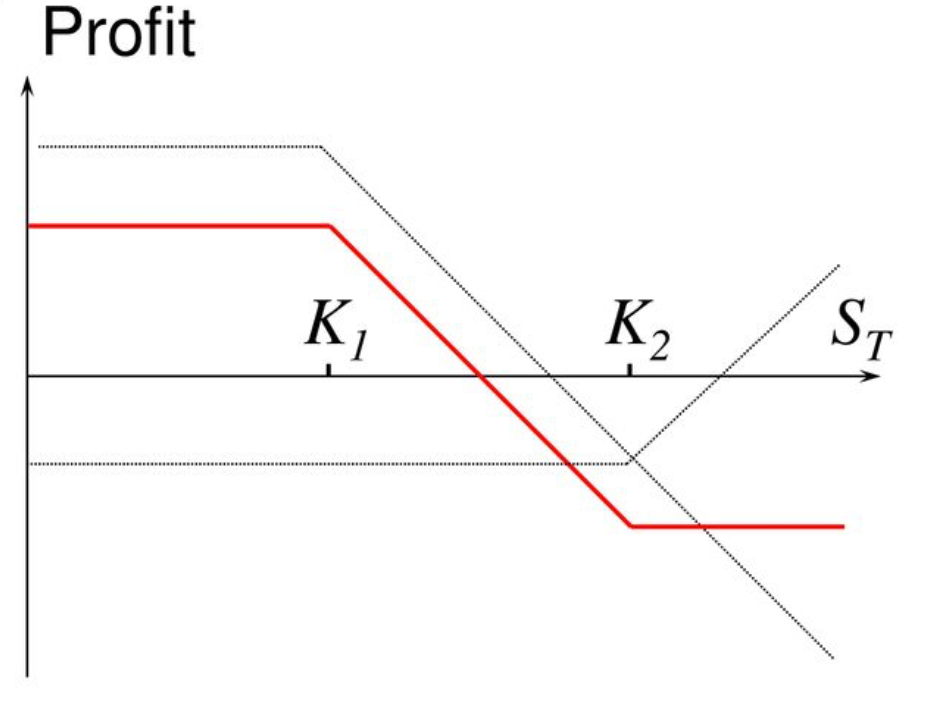

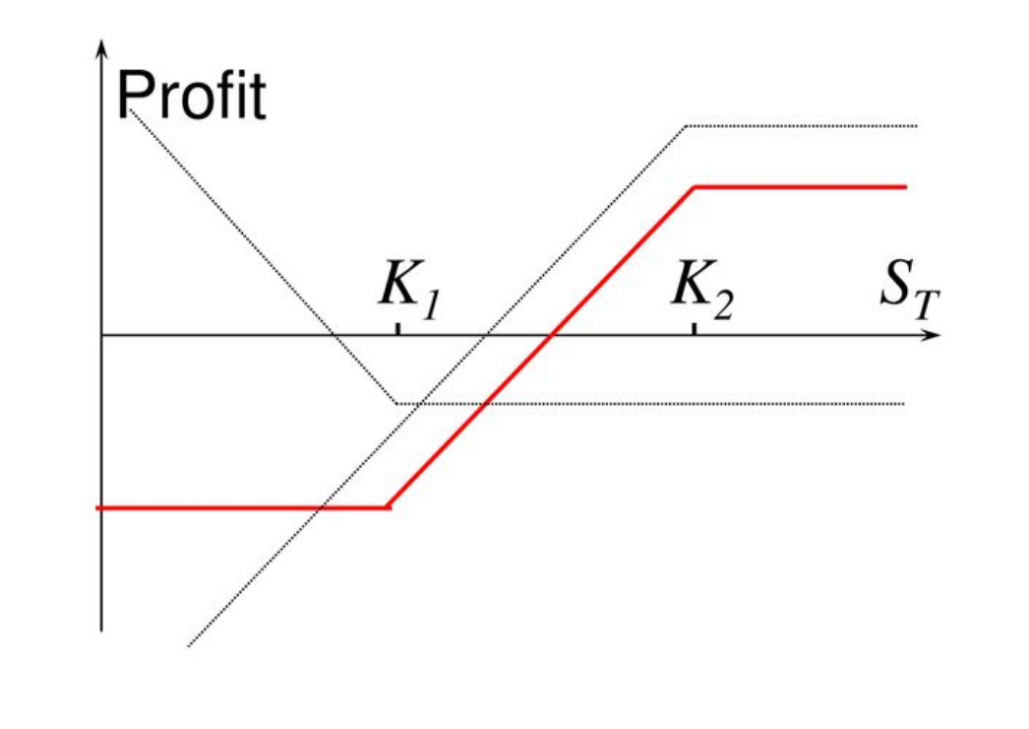

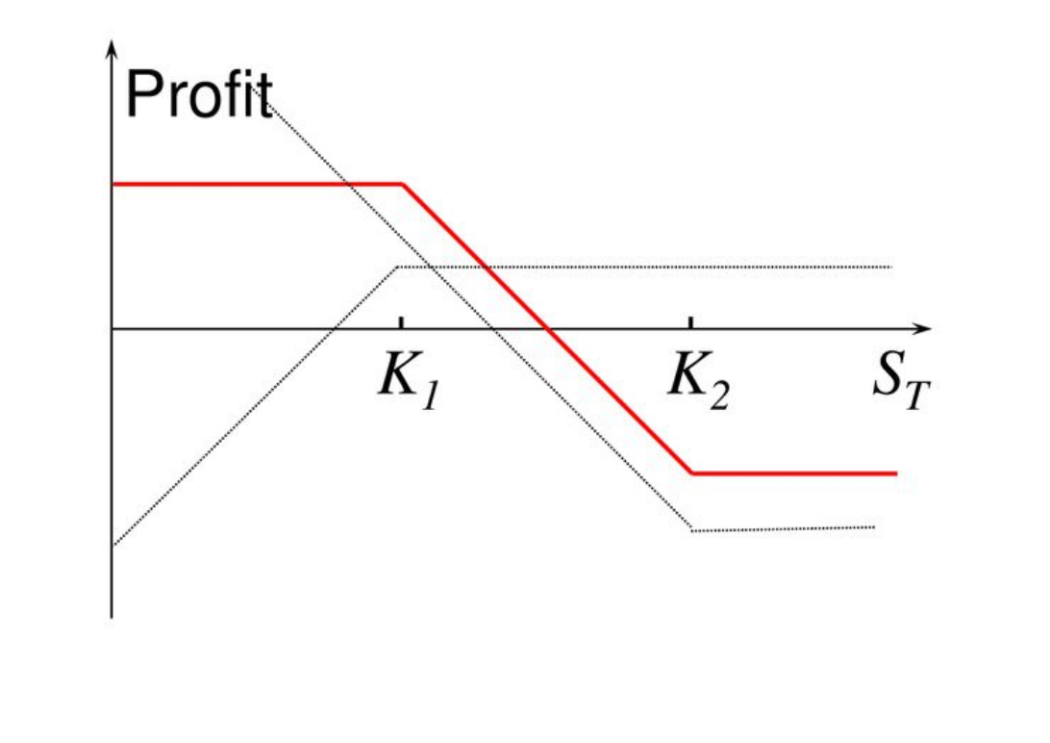

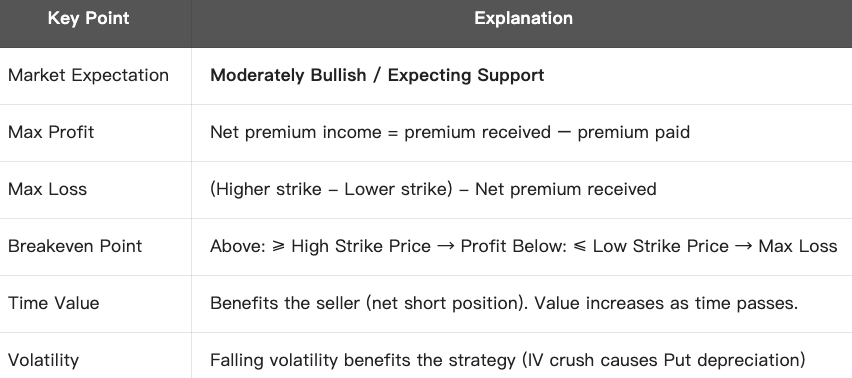

Bear Put Spread Strategy

Bear Put Spread is a directional options strategy, ideal when you have a bearish outlook and anticipate the underlying to decline moderately. The strategy involves buying and selling Put options at different strikes simultaneously, offering defined risk and defined reward.

Strategy Components:

Requirements:

K1>K2

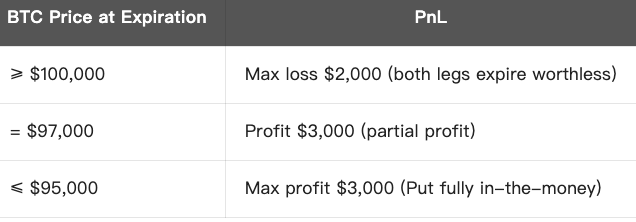

Example (Using BTC):

Assume current BTC market price is $100,000. You expect BTC to decline to around $95,000.

You construct the following Bear Put Spread:

- Net cost = $2,000 (max loss)

- Max profit = Strike spread - Cost = $5,000 - $2,000 = $3,000

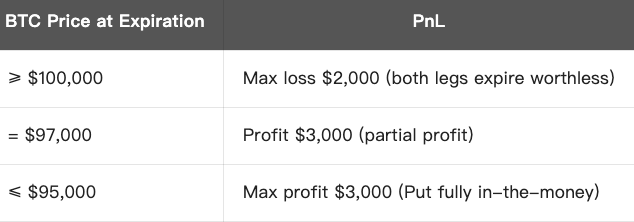

PnL at Expiration:

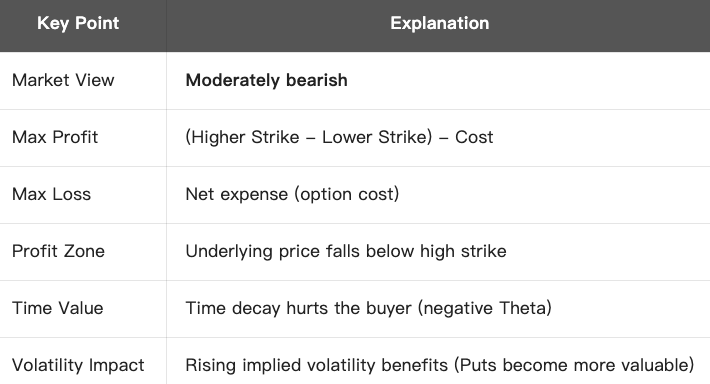

Strategy Summary:

Conclusion:

Bear Put Spread is an options combination strategy for bearish markets, using lower costs to bet on moderate decline, avoiding the high cost and high risk exposure of naked Put buying, suitable for conservative bearish investors.

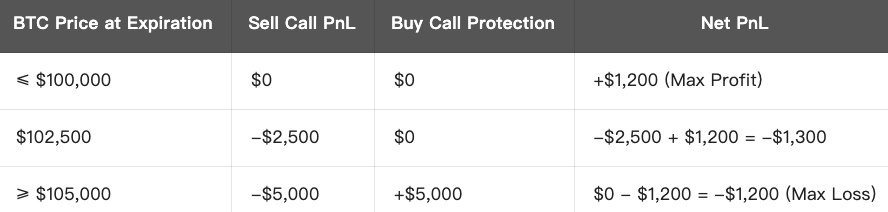

Covered Call Strategy

- Definition: An investor holds a certain amount of the underlying asset (such as BTC) and sells an equal number of call options on that asset. This means the investor collects premium while accepting that if the underlying price rises above the strike price at expiration, they will be forced to sell the asset.

Advantages :

Premium Income: Generate additional income from selling options while holding the underlying asset.

- Limited Risk: Since you own the underlying, risk is theoretically limited, only missing some upside potential.

- Suitable for Neutral or Mildly Bullish Markets: When the underlying price is near or below the strike price at expiration, investors can keep the asset and retain the premium.

Disadvantages:

Capped Upside: If the underlying price rises significantly, profit is limited to the strike price plus premium received.

Example (BTC ≈ $100,000):Example (Using BTC):

Assume that current BTC market price is $100,000. You expect BTC to rise in the next few days but with limited upside (perhaps to $105,000 max):

Total Cost (Net Expense):

= Premium paid - Premium received = $1,200 - $500 = $700

PnL at Expiration:

Strategy Summary:

Conclusion:

The Bull Call Spread Strategy is suitable for the moderately bullish market, using lower cost for a higher winning rate of risk-return balance.

Bear Call Spread Strategy

The bear call spread is a limited-risk, limited-return strategy suitable when you expect the market to decline or trade sideways, unlikely to rally significantly.

Strategy Components:

Sell one lower-strike call option

Buy one higher-strike call option Both options share the same expiration date

Note: Unlike the bull call spread Strategy, this combination generates net premium income.

Example (BTC ≈ $100,000):

If you believe BTC won’t rise above $105,000, you can follow the strategy below:

Net Premium Income:

= $2,000 (Sell) ‑ $800 (Buy) = $1,200 (Max Profit)

PnL at Expiration:

Strategy Summary:

Conclusion:

The Bear Call Spread is a conservative strategy for bearish or range-bound markets, profiting if the price doesn’t rise significantly, suitable for stable or weak market conditions.

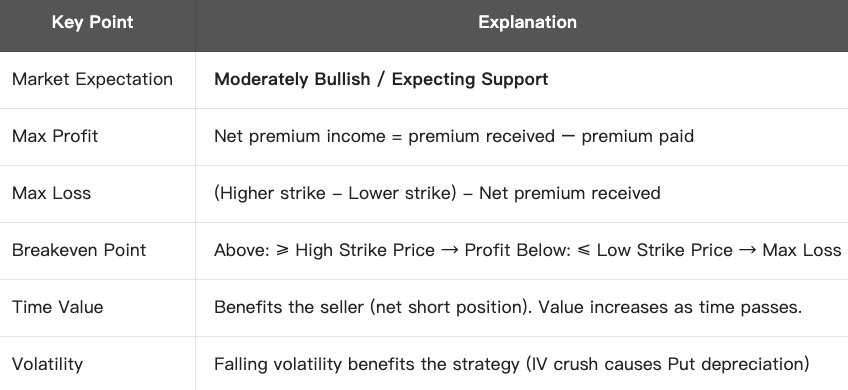

Bull Put Spread Strategy

Bull Put Spread is a directional option combination strategy used when moderately bullish or expecting the market not to fall below a certain level. It involves selling and buying puts at different strikes, limiting both risk and reward.

Strategy Components:

Requirements:

Same expiration date; K₁ > K₂.

Example (Using BTC):

Current BTC price: $100,000

If you believe BTC won’t drop below $95,000, you can follow the strategy below:

- Net income = $1,000 − $500 = $500 (max profit)

- Max Loss = Strike spread − Net income = $5,000 − $500 = $4,500

PnL at Expiration:

Strategy Summary:

Conclusion:

Bull Put Spread is a limited-risk, limited-reward short Put combination strategy, ideal when you expect the underlying to appreciate or maintain support above a key level,offering better probability of success than outright long positions while keeping risk manageable.

Bear Put Spread Strategy

Bear Put Spread is a directional options strategy, ideal when you have a bearish outlook and anticipate the underlying to decline moderately. The strategy involves buying and selling Put options at different strikes simultaneously, offering defined risk and defined reward.

Strategy Components:

Requirements:

K1>K2

Example (Using BTC):

Assume current BTC market price is $100,000. You expect BTC to decline to around $95,000.

You construct the following Bear Put Spread:

- Net cost = $2,000 (max loss)

- Max profit = Strike spread - Cost = $5,000 - $2,000 = $3,000

PnL at Expiration:

Strategy Summary:

Conclusion:

Bear Put Spread is an options combination strategy for bearish markets, using lower costs to bet on moderate decline, avoiding the high cost and high risk exposure of naked Put buying, suitable for conservative bearish investors.

Covered Call Strategy

- Definition: An investor holds a certain amount of the underlying asset (such as BTC) and sells an equal number of call options on that asset. This means the investor collects premium while accepting that if the underlying price rises above the strike price at expiration, they will be forced to sell the asset.

Advantages :

Premium Income: Generate additional income from selling options while holding the underlying asset.

- Limited Risk: Since you own the underlying, risk is theoretically limited, only missing some upside potential.

- Suitable for Neutral or Mildly Bullish Markets: When the underlying price is near or below the strike price at expiration, investors can keep the asset and retain the premium.

Disadvantages:

Capped Upside: If the underlying price rises significantly, profit is limited to the strike price plus premium received.

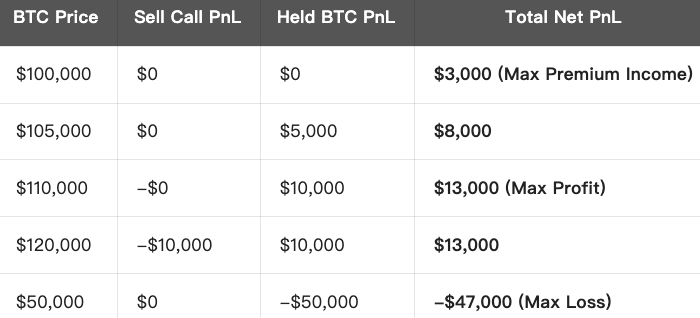

Example (BTC ≈ $100,000):

Assume that the current BTC market price is $100,000, you already hold 1 BTC, and decide to use a covered call strategy:

Net Profit Calculation:

Premium received from selling option: $3,000

Max Profit: If the BTC price is above $110,000 at expiration, you will be forced to sell your BTC at $110,000, plus the $3,000 premium received.

- Max Profit = $110,000 (strike price) + $3,000 (premium) - $100,000 (holding cost) = $13,000

Max Loss: If BTC price drops to $0, maximum loss equals the full value of held BTC.

- Max Loss = $100,000 (holding cost) - $3,000 (premium received) = $97,000

Breakeven Point: When BTC price equals $100,000 + $3,000 (premium).

- Breakeven Point = $100,000 + $3,000 = $103,000 .

PnL at Expiration:

Conclusion:

- Covered calls are suitable for bullish or neutral markets, especially when the market is not expected to rise significantly.

- This strategy generates premium income while holding the underlying asset.

- However, if the market rises significantly, max profit is capped at the strike price plus premium.

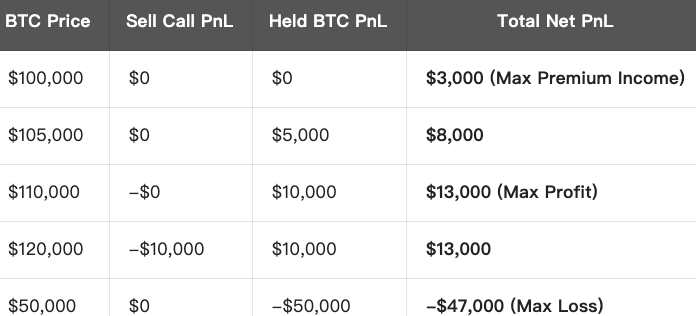

Assume that the current BTC market price is $100,000, you already hold 1 BTC, and decide to use a covered call strategy:

Net Profit Calculation:

Premium received from selling option: $3,000

Max Profit: If the BTC price is above $110,000 at expiration, you will be forced to sell your BTC at $110,000, plus the $3,000 premium received.

- Max Profit = $110,000 (strike price) + $3,000 (premium) - $100,000 (holding cost) = $13,000

Max Loss: If BTC price drops to $0, maximum loss equals the full value of held BTC.

- Max Loss = $100,000 (holding cost) - $3,000 (premium received) = $97,000

Breakeven Point: When BTC price equals $100,000 + $3,000 (premium).

- Breakeven Point = $100,000 + $3,000 = $103,000 .

PnL at Expiration:

Conclusion:

- Covered calls are suitable for bullish or neutral markets, especially when the market is not expected to rise significantly.

- This strategy generates premium income while holding the underlying asset.

- However, if the market rises significantly, max profit is capped at the strike price plus premium.