DivinePoint

Publique conteúdo & ganhe rendimento de conteúdo de mineração

placeholder

- Recompensa

- 1

- 2

- Compartilhar

GateUser-39a0175c :

:

Acabei de ver, Fechar posição.Ver projetos

#6 BTC全民空投限时派送中# #Gate Alpha积分撸40U# Esta semana é necessário seguir as grandes notícias. No dia 7 de agosto, a grande queda dos impostos foi concretizada, a informação desfavorável foi totalmente absorvida, resultando em uma informação favorável. Além disso, o Bitcoin teve um ponto baixo esta semana de 112 mil dólares, então essa posição é muito boa e conservadora para entrar. Lembre-se que, mesmo que intencionalmente haja uma vela de pavio longo quebrando para baixo e depois voltando, isso ainda conta como suporte, porque muitas pessoas colocaram tudo em para ir longo a 112 mil, e o stop loss f

BTC0.67%

- Recompensa

- 1

- Comentário

- Compartilhar

Hoje, o mercado de ativos de criptografia teve uma recuperação, com o Litecoin (LTC) a destacar-se, apresentando uma forte tendência de aumento. Este aumento repentino surpreendeu muitos investidores e gerou amplas discussões no mercado.

Enquanto isso, o volume de negociação de futuros da Solana atingiu um novo recorde, refletindo ainda mais o nível de atividade atual do mercado de Ativos de criptografia. Esses sinais parecem prever que o mercado pode estar entrando em uma nova fase.

No entanto, é importante notar que a volatilidade do mercado de Ativos de criptografia tem sido muito alta, e o

Ver originalEnquanto isso, o volume de negociação de futuros da Solana atingiu um novo recorde, refletindo ainda mais o nível de atividade atual do mercado de Ativos de criptografia. Esses sinais parecem prever que o mercado pode estar entrando em uma nova fase.

No entanto, é importante notar que a volatilidade do mercado de Ativos de criptografia tem sido muito alta, e o

- Recompensa

- 6

- 6

- Compartilhar

FunGibleTom :

:

fazer as pessoas de parvas um pouco não é exagero, certo~Ver projetos

- Recompensa

- curtir

- Comentário

- Compartilhar

Notícias do CoinWorld, a empresa listada na Nasdaq Mogo anunciou que converteu seu investimento de cerca de 13,8 milhões de dólares na WonderFi Technologies em dinheiro, o que representa quase 50% de sua participação total na empresa. A Mogo irá alocar os lucros desta monetização de acordo com sua estratégia de capital de longo prazo, pretendendo aumentar seu investimento em BTC para cerca de 2 milhões de dólares, fortalecendo ainda mais suas reservas estratégicas de Bitcoin.

BTC0.67%

- Recompensa

- curtir

- Comentário

- Compartilhar

Ponto de precisão do contrato de Éter de BTC (versão otimizada da página), como de costume, abra uma ordem em que posição, promoção por tempo limitado de subscrição de 2GT, todos os contratos de altcoin em um só lugar, agarre imediatamente o ponto de explosão do contrato de BTC de Éter

,

,,,BTC多空分界线114800

BTC

Abrir posição longa nos níveis de suporte 113800/112800/111300

Ponto de pressão para venda a descoberto 115900/116900/118300

(Estável 1%2%3%) (Radical 2%/3%/5%)

Ponto de lucro, linha de divisão entre posições longas e curtas, estratégia conservadora e visão agressiva para o ponto de venda

Ver original,

,,,BTC多空分界线114800

BTC

Abrir posição longa nos níveis de suporte 113800/112800/111300

Ponto de pressão para venda a descoberto 115900/116900/118300

(Estável 1%2%3%) (Radical 2%/3%/5%)

Ponto de lucro, linha de divisão entre posições longas e curtas, estratégia conservadora e visão agressiva para o ponto de venda

- Recompensa

- 6

- 1

- Compartilhar

KatyPaty :

:

1000x Vibes 🤑- Recompensa

- curtir

- Comentário

- Compartilhar

Então, como podemos pagar os custos de desenvolvimento sobre tudo isso? E se vendermos a moeda que temos, por que continuamos a construir sobre a moeda?

Parece-me uma desculpa que as pessoas queiram extrair valor da nossa moeda enquanto lutamos para construir e sustentar o projeto.

O problema central aqui é

Ver originalParece-me uma desculpa que as pessoas queiram extrair valor da nossa moeda enquanto lutamos para construir e sustentar o projeto.

O problema central aqui é

- Recompensa

- 8

- 3

- Compartilhar

SchrodingerWallet :

:

fazer as pessoas de parvas就不干活了Ver projetos

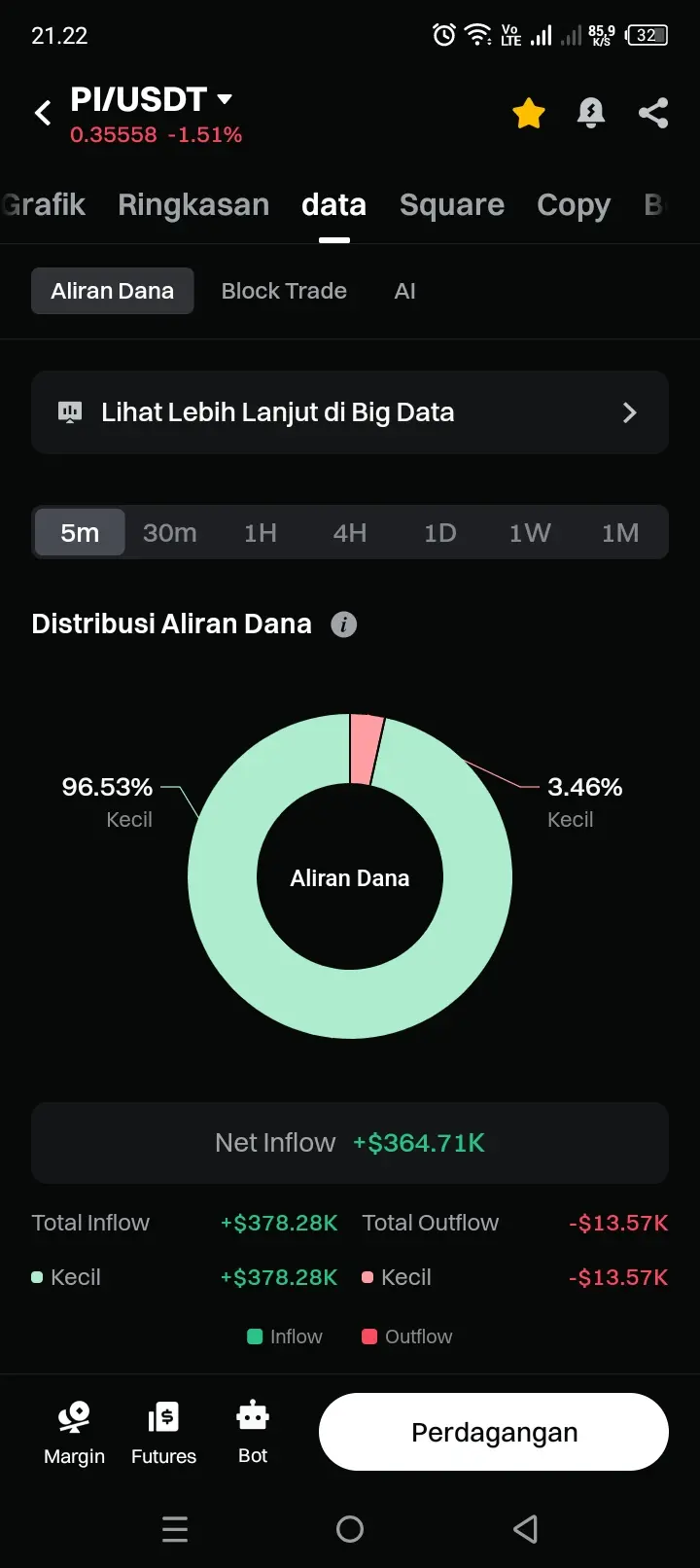

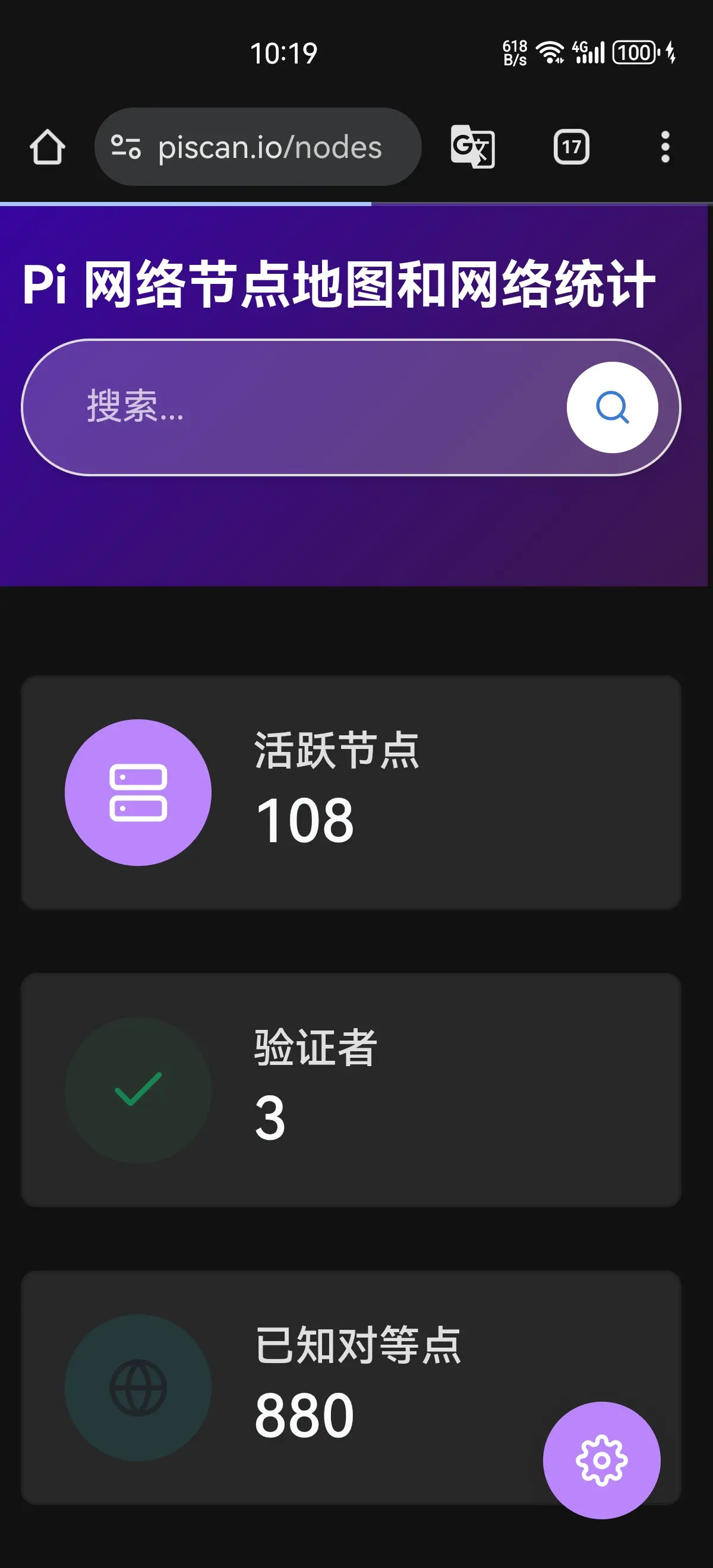

#PI# Existem mais de 700 nós globais, agora restam apenas 108 nós em operação, todos desconectados. Nenhum na China, a bolha emocional finalmente estourou, é prudente ir longo. Quando o mercado não vê esperança, qualquer lugar pode ter uma queda de 50%. Calculando a partir de 3U, a possibilidade de cair 98% também existe. Existem muitos projetos assim no mercado de moedas, ou seja, 0.06U$.

PI0.03%

- Recompensa

- 1

- 9

- Compartilhar

GateUser-29a74151 :

:

Eu também cavei por alguns anos, não vou comprar nenhum. Esse casal apenas trata os amigos como macacos.Ver projetos

Receba gratuitamente 100 dólares em moedas de oferta: clique para receber diretamente na sua conta

https://gate.com/live/video?stream_id=a8d11abcb9c94c6ca918dcc7f60fa88e&session_id=a8d11abcb9c94c6ca918dcc7f60fa88e-1754301969&ref=VGQRA10LVA&ref_type=104

Ver originalhttps://gate.com/live/video?stream_id=a8d11abcb9c94c6ca918dcc7f60fa88e&session_id=a8d11abcb9c94c6ca918dcc7f60fa88e-1754301969&ref=VGQRA10LVA&ref_type=104

- Recompensa

- curtir

- 1

- Compartilhar

GuiguZonghengJiaWeizh :

:

快 entrar numa posição!🚗Bom dia

Apenas alguns homens conseguem entender isso

Ver originalApenas alguns homens conseguem entender isso

- Recompensa

- curtir

- Comentário

- Compartilhar

- Recompensa

- curtir

- 3

- Compartilhar

GateUser-8f5b6f70 :

:

Você é um idiota, não é?Ver projetos

- Recompensa

- 12

- 4

- Compartilhar

MeaninglessApe :

:

comprar na baixa agora é issoVer projetos

Estranho como alguns projetos de topo não estão a aparecer na página de Ganhar de uma certa plataforma de IA.

Alguns projetos estão a realizar campanhas sólidas, mas muitas pessoas estão completamente alheias, simplesmente porque não estão listados.

Tanto a plataforma de IA como as equipas poderiam fazer melhor aqui. Visibilidade = Participação.

Ver originalAlguns projetos estão a realizar campanhas sólidas, mas muitas pessoas estão completamente alheias, simplesmente porque não estão listados.

Tanto a plataforma de IA como as equipas poderiam fazer melhor aqui. Visibilidade = Participação.

- Recompensa

- 8

- 6

- Compartilhar

BearMarketNoodler :

:

A nova atualização não está sincronizada = não consegui aproveitar a oportunidade.Ver projetos

#TBC# #TBC# #TBC# #TBC#

TBC (Turing Bit Chain) carrega a visão da primeira blockchain pública da Ásia, África e América Latina, mantendo a pureza da linhagem do Bitcoin, desenvolvendo uma solução Layer 2 para o Bitcoin, para que várias performances técnicas sejam implementadas na construção do ecossistema!

——O TBC está brilhando! É uma longa jornada! Está subindo devagarinho.

Ver originalTBC (Turing Bit Chain) carrega a visão da primeira blockchain pública da Ásia, África e América Latina, mantendo a pureza da linhagem do Bitcoin, desenvolvendo uma solução Layer 2 para o Bitcoin, para que várias performances técnicas sejam implementadas na construção do ecossistema!

——O TBC está brilhando! É uma longa jornada! Está subindo devagarinho.

- Recompensa

- curtir

- Comentário

- Compartilhar

Peço, por favor, que as instituições Forex não me escrevam. Recebi mensagens de 20 empresas diferentes.

Não usamos Forex...

Ver originalNão usamos Forex...

- Recompensa

- curtir

- Comentário

- Compartilhar

Visão geral das principais atualizações em 4 de agosto de 2025

1. A posse de Bitcoin da MARA ultrapassa 50.000 moedas

2.A Bitmine detém mais de 833 mil ETH

3.Estratégia comprar 21.000 BTC em uma semana

4. Na semana passada, saíram 223 milhões de dólares em investimentos em criptomoedas.

5. A SEC revelou que a Tesla concederá novas ações a Musk

6.DeFi Dev aumentou a sua posição em 110 mil SOL, ultrapassando um milhão.

7.Plano de verbas para a arrecadação privada de 5,58 bilhões de dólares para a reserva TON

Ver original1. A posse de Bitcoin da MARA ultrapassa 50.000 moedas

2.A Bitmine detém mais de 833 mil ETH

3.Estratégia comprar 21.000 BTC em uma semana

4. Na semana passada, saíram 223 milhões de dólares em investimentos em criptomoedas.

5. A SEC revelou que a Tesla concederá novas ações a Musk

6.DeFi Dev aumentou a sua posição em 110 mil SOL, ultrapassando um milhão.

7.Plano de verbas para a arrecadação privada de 5,58 bilhões de dólares para a reserva TON

- Recompensa

- curtir

- Comentário

- Compartilhar

Olá família Square! Quantos pontos Alfa você acumulou ultimamente?

Recebeste o teu airdrop? Temos também vantagens extra para ti no Gate Square!

🎁 Mostre os seus ganhos de pontos Alfa, e terá uma chance de ganhar uma recompensa de uma Caixa Misteriosa de $200U!

🥇 1 utilizador com a maior pontuação captura de ecrã → $100U Caixa Mistério

✨ Top 5 partilhadores com publicações de qualidade → $20U Caixa Mistério cada

📍【Como Juntar】

1️⃣ Faça uma publicação com a hashtag #ShowMyAlphaPoints#

2️⃣ Partilhe uma captura de ecrã dos seus pontos Alfa, mais uma frase: "Ganhei ____ com o Gate Alpha. Valeu

Ver originalRecebeste o teu airdrop? Temos também vantagens extra para ti no Gate Square!

🎁 Mostre os seus ganhos de pontos Alfa, e terá uma chance de ganhar uma recompensa de uma Caixa Misteriosa de $200U!

🥇 1 utilizador com a maior pontuação captura de ecrã → $100U Caixa Mistério

✨ Top 5 partilhadores com publicações de qualidade → $20U Caixa Mistério cada

📍【Como Juntar】

1️⃣ Faça uma publicação com a hashtag #ShowMyAlphaPoints#

2️⃣ Partilhe uma captura de ecrã dos seus pontos Alfa, mais uma frase: "Ganhei ____ com o Gate Alpha. Valeu

- Recompensa

- 8

- 12

- Compartilhar

Iwok_martingle :

:

atraente atraente Ver projetos

$BTC

As pessoas que estão ansiando agora provavelmente estão ansiando cedo demais.

As pessoas que estão ansiando agora provavelmente estão ansiando cedo demais.

BTC0.67%

- Recompensa

- curtir

- Comentário

- Compartilhar

O mundo financeiro está passando por uma transformação, e a Huma Finance, como a primeira rede PayFi do mundo, está na vanguarda dessa revolução. Ao transformar de forma inovadora folhas de pagamento, faturas e outros fluxos de receita em ativos digitais que podem ser emprestados, a Huma Finance está utilizando a tecnologia Blockchain para redefinir o valor do tempo do capital.

Na resolução dos pontos críticos das finanças tradicionais, a infraestrutura de seis camadas da Huma Finance, o PayFi Stack, apresenta um desempenho excecional. Não só permite a liquidação instantânea de remessas intern

Na resolução dos pontos críticos das finanças tradicionais, a infraestrutura de seis camadas da Huma Finance, o PayFi Stack, apresenta um desempenho excecional. Não só permite a liquidação instantânea de remessas intern

HUMA6.9%

- Recompensa

- 15

- 4

- Compartilhar

StakeTillRetire :

:

Anual de 24 é demasiado absurdo, não é?Ver projetos

Depositar mais

- Tema1/3

12k Popularidade

166k Popularidade

20k Popularidade

101k Popularidade

82k Popularidade

- Marcar